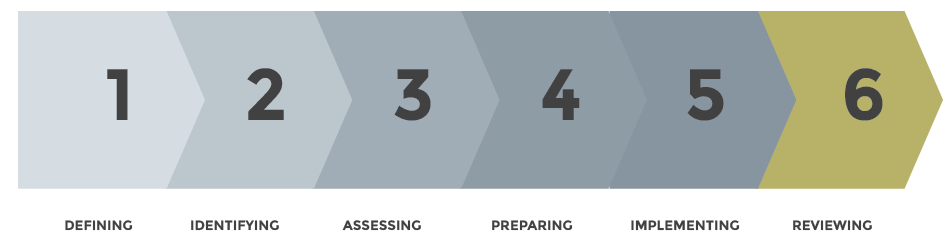

OUR PROCESS

Straightforward and down-to-earth, helping you to achieve your financial goals.

1. Defining the Relationship

The financial planner will explain the process they’ll follow, find out what your needs are and make sure they can meet them. You can ask them about their background, how they work and how they charge.

2. Identifying your Goals

You work with the financial planner to identify your short and long term financial goal – this stage serves as a foundation for developing your plan.

3. Assessing you Financial Situation

The financial planner will take a good look at your position – your assets, liabilities insurance coverage and investment or tax strategies.

5. Preparing your Financial Plan

The financial planner recommends suitable strategies, products and services, and answers any questions you have.